Build Real Financial Skills That Actually Matter

Forget generic advice and surface-level tips. Our program gives you practical knowledge to manage money, understand investments, and make decisions that fit your actual life. Starting September 2025.

Book a Program ChatWhat You'll Learn Here

This isn't about getting rich quick or playing the stock market. It's about understanding how money works in everyday situations—budgeting without feeling restricted, saving without sacrificing everything you enjoy, and investing in ways that match your comfort level.

We focus on Australian financial systems specifically. Tax structures, superannuation, property markets, banking options—all the stuff that matters when you're actually living and working here.

- Budgeting methods that work with irregular income

- Understanding superannuation choices and strategies

- Tax planning basics for employees and contractors

- Investment options explained without the jargon

- Property market fundamentals for Australian buyers

- Debt management approaches that actually reduce stress

Classes run twice weekly in the evenings, with recordings available. You can catch up if you miss one—because life happens, and we're not going to pretend it doesn't.

What the Program Covers

Twelve weeks of focused learning. Each module builds on the previous one, but if you already know something, you're welcome to skip ahead. The goal is useful knowledge, not checking boxes.

Weeks 1-3: Money Basics

How money flows through your life. Income types, expense tracking that doesn't take hours, and building budgets that bend without breaking.

- Cash flow analysis

- Budget frameworks

- Emergency fund sizing

- Banking account structures

Weeks 4-6: Tax & Super

Australian tax system explained properly. Deductions, brackets, super contributions, and how to work with accountants effectively.

- Income tax fundamentals

- Superannuation options

- Salary sacrifice strategies

- Tax return preparation

Weeks 7-9: Investing Foundations

Shares, ETFs, bonds, property—what they are, how they work, and matching options to your situation. No get-rich schemes, just reality.

- Investment vehicle types

- Risk assessment

- Portfolio construction

- Fee structures decoded

Weeks 10-12: Property & Debt

Mortgages, refinancing, property buying process. Also: managing debt sensibly and knowing when borrowing makes sense.

- Home loan comparison

- Property market research

- Debt consolidation options

- Credit score management

Ongoing: Insurance & Protection

Income protection, life insurance, health cover—boring but important. Understanding what you need versus what gets sold to you.

- Insurance type comparison

- Coverage calculation

- Policy review methods

- Claims process basics

Final Week: Personal Planning

Putting everything together into a plan that fits your life. Setting goals that matter to you, not some template.

- Financial goal setting

- Plan creation workshop

- Review scheduling

- Resource library access

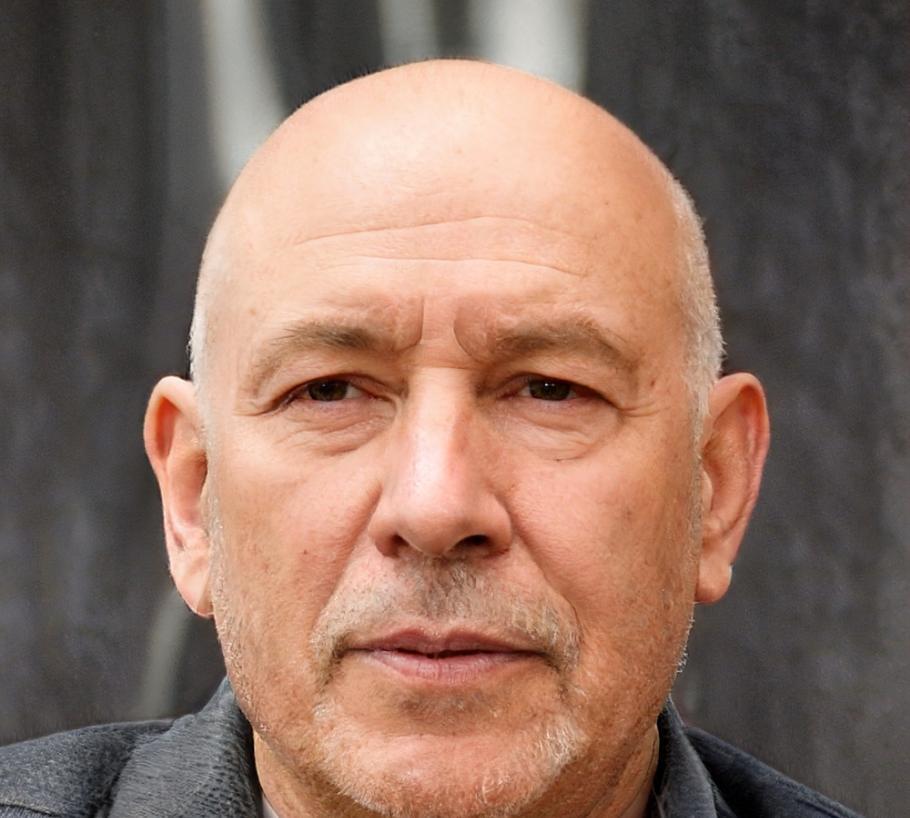

Callum Bridgewater

Lead Instructor

Former mortgage broker turned educator. Spent eight years helping clients navigate property purchases before switching to teaching.

Henrik Valtonen

Tax Specialist

Tax accountant who actually explains things clearly. Covers the tax and super modules with real examples.

Who Teaches This

Both instructors worked in financial services before moving into education. They've seen the confusing advice, the overselling, and the gaps in what people actually understand about money.

Classes are conversational. You can ask questions without feeling stupid. If something doesn't make sense, we explain it differently until it clicks.

They're not here to sell you products or push specific investments. The focus stays on understanding your options so you can make informed choices yourself.

Program Schedule and Format

The next cohort starts September 2025 and runs through November. Classes happen Tuesday and Thursday evenings from 6:30 to 8:00 PM AEST. You attend live online or watch recordings—both work fine.

Each session includes teaching time, practical exercises, and Q&A. Between classes, there's a discussion forum where you can ask questions or share what you're working on.

Registration Opens: July 2025

Sign up opens in July. Limited to 40 people per cohort so everyone gets attention during sessions.

Program Begins: September 3, 2025

First session covers money basics and sets expectations. You'll get access to all course materials and the online platform.

Mid-Program Check: October 2025

Week six includes a review session where we address common questions and adjust pace if needed.

Program Completes: November 21, 2025

Final session focuses on your personal financial plan. You'll leave with a roadmap you created yourself.

Alumni Access: Ongoing

After completing, you keep access to updated materials and can join quarterly review sessions for continuing support.